Invest

Very good conditions in stock markets in 2013

Summary 2013

- Very good conditions in stock markets in 2013.

- Ferd Invest again generated a better investment return than the market as a whole.

- Continuing high degree of optimism for 2014.

Markets

2013 was a strong year for the Nordic stock markets. The Nordic markets gained between 46% (Helsinki) and 23% (Oslo) in Norwegian kroner terms. The weakness of the Norwegian kroner was the main reason for the other Nordic markets to produce higher returns for us than the Oslo market in 2013.

With the exception of some "emerging markets", most countries saw improvement in economic conditions in 2013, or at least avoided any major setbacks. USA re-established its position as the engine for global growth, and it seems that most EU countries passed the low point of the economic cycle in 2013. In overall terms, 2013 was a year in which investors could remove many items from their "worry list", and this made them willing to price shares somewhat higher. This was confirmed by the fact that rising share prices were driven by higher pricing ratios rather than growth in corporate earnings.

Ferd Invest’s history of good investment returns was further strengthened in 2013.

Investment Return

The market value of Ferd Invest’s total portfolio increased by 41.2% in 2013, which was 2.7% better than our benchmark index. The good return was principally achieved by avoiding making particularly bad investments in 2013.

Opera, which was our largest holding throughout 2013, gained 163% for the year. Together with strong performance from Autoliv, Novozymes and Transmode, Opera made the biggest contribution to yet another good year for Ferd Invest.

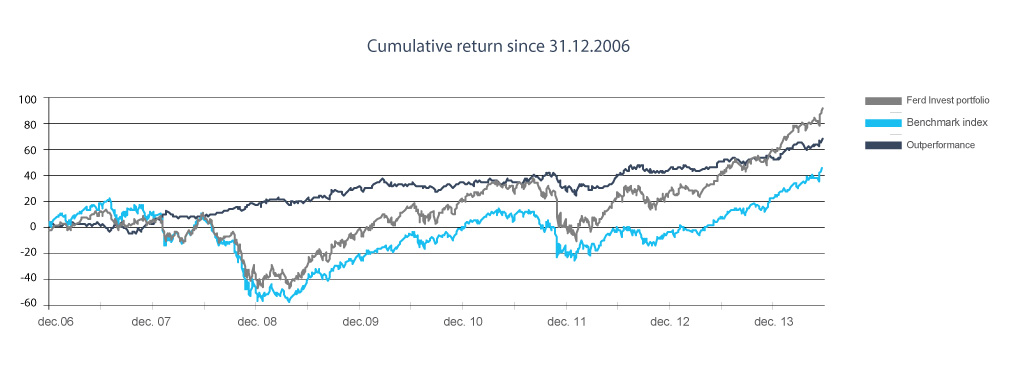

Ferd Invest’s history of good investment returns was further strengthened in 2013. Over the last seven years, the return on the portfolio has been significantly higher than the relevant benchmark indices. Our portfolio has outperformed the market by all of 52% since 31 December 2006.

Portfolio

At the close of 2013, the market value of the Ferd Invest portfolio was NOK 5 billion. Investments were divided between the three Scandinavian stock markets, as well as the Helsinki stock market. The largest investments at the close of 2013 were in Opera, TDC, Autoliv, Novo Nordisk and Nokian Tyres, and these investments accounted for around 35% of the total value of the portfolio at year-end. Our benchmark index is the MSCI Nordic Mid Cap Index.

Continuing high degree of optimism for 2014.

Organisation

The Ferd Invest team currently has three members. There were no changes to the Ferd Invest team in 2013.

Future Prospects

The emerging optimism that we described at the start of last year was successfully reinforced over the course of 2013. It is said that a bull market progresses by climbing a wall of worry. If this is the case, the wall became much less solidly built over the course of 2013. This has made us somewhat concerned over the scope for markets to continue to rise in 2014.

Regardless of the general direction in the stock market, Ferd Invest aims to outperform the market through its selection of individual shares for investment. We are now moving into a phase where it will be increasingly difficult for companies to satisfy market expectations for their earnings. If we are able to find the companies that can satisfy these expectations, then we believe that 2014 will be another successful year for Ferd Invest.