Board of Director's Report

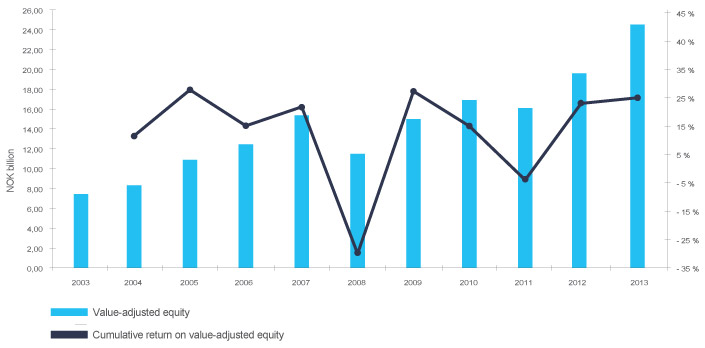

At the close of 2013, Ferd’s value-adjusted equity was NOK 24.3 billion.

2013 was a very good year for Ferd. The year was characterised by greater optimism in the world's financial markets. Stock markets in the Nordic countries, the USA and other developed markets produced high returns in 2013. Expansive monetary policy measures implemented by central banks in Europe and the USA, combined with relatively attractive pricing for equities compared to bonds, and better growth prospects, were the main reasons for the high stock market returns.

At the close of 2013, Ferd’s value-adjusted equity was NOK 24.3 billion. At the start of 2013, value-adjusted equity was NOK 19.6 billion. After adjusting for dividends, this represents a return of NOK 4.9 billion, equivalent to approximately 25%. The Norwegian krone fell sharply in value against the euro and the US dollar in 2013. Around 40% of Ferd's overall portfolio is invested in Norwegian krone denominated assets. Ferd recorded a sizeable currency gain in 2013, particularly on the Ferd Invest portfolio and the investment in Elopak. Ferd's return was somewhat better than the return achieved on the Oslo Stock Exchange, which closed the year with a return just under 24%.

At the start of 2013, value-adjusted equity was NOK 19.6 billion.

Ferd's average annual return over the last five years was 17.7%. Over the same period the Benchmark Index for the Oslo Stock Exchange (OSEBX) generated a 19.5% average annual return, while the global stock market index (MSCI) produced a return of 12.6% in Norwegian krone terms. The overall Nordic market was up by 16.1% annually over the period. Ferd's results have been achieved as the result of sound operations and good earnings by the companies in which Ferd holds substantial ownership positions, and a sound return from most of the financial investment areas. Both liquidity and capital adequacy have been extremely strong throughout the period, and Ferd’s risk exposure has been in accordance with the owner’s desired risk profile.

2013 was a year in which Ferd carried out sizeable disposals at the start of the year and then allocated significant amounts of capital to its business areas over the remainder of the year.

2013 was a year in which Ferd carried out sizeable disposals at the start of the year and then allocated significant amounts of capital to its business areas over the remainder of the year. In the first half of 2013, Ferd received payments of just under NOK 3.4 billion from the reduction in its shareholding in Aibel and the sale of Pronova by Herkules Fund I to Beerenberg. Ferd allocated almost NOK 1 billion to Ferd Invest and Ferd Hedge Funds in the first quarter of 2013. Ferd Capital maintained a high level of activity in 2013, including the purchase of Servi Group in the summer. In January 2014, Ferd Capital increased its ownership in Interwell from 34% to 58%. Ferd Real Estate invested over NOK 400 million in its current projects and in acquisitions of new properties in 2013.

Ferd experienced good access to loan financing in 2013, with greater competition between the Nordic banks for lending business. Ferd took the opportunity to increase its overall credit facility from NOK 5.0 billion to NOK 6.0 billion in 2013. At the close of 2013, Ferd AS (parent company) did not have any outstanding drawings on its credit facility.

The future outlook for the securities markets will depend in part on how the central banks conduct monetary policy. We are entering a period in which low interest rates and central bank actions to provide significant liquidity to the markets coincide with improving economic growth. In Norway, there are signs of a weaker outlook for economic growth. Investment spending in the Norwegian oil sector is expected to be in the order of NOK 200 billion in 2014. This represents a levelling off for oil sector investment after many years of rapid growth. Given the current level of pricing seen in stock markets, particularly in the USA, continuing growth in corporate earnings will be needed if the market outlook is to remain positive. This in turn means that in order for stock markets to continue to generate a good return, it is essential that the American economy maintains its growth and that European economies show further improvement.

The Board believes that 2014 may offer good investment opportunities for a number of Ferd's business areas, and the Board is confident that Ferd has the financial and organisational resources to ensure that it is well-placed to take advantage of the opportunities that arise.

The group's value-adjusted equity

Ferd’s target is to achieve average annual growth in value-adjusted equity of at least 10% over time. Over the period 2003-2013, Ferd generated a total return of NOK 18.2 billion, equivalent to an annual return of 13.6%.

Ferd holds a broadly diversified portfolio of listed and unlisted equity investments, alternative investments and real estate. Ferd's equity investments provide good diversification between different sectors and geographical markets and between companies at different stages of the corporate life cycle. The value of the group’s unlisted investments increased in 2013, and Ferd Capital’s portfolio represents just under 40% of Ferd’s value-adjusted equity.

Ferd’s sound return in 2013 reflects very good results from three of the five investment areas. Most of the companies in Ferd Capital’s portfolio performed well in 2013, with the increase in value of Elopak making a particularly strong contribution. Ferd Invest’s Nordic portfolio generated a return of 41%, which was three percentage points higher than the return on the benchmark index for this portfolio. Ferd Special Investments also reported very good returns, both in absolute and relative terms. Ferd Hedge Funds reported a satisfactory return in 2013. The return on the hedge fund portfolio was 8%, while Ferd's real estate portfolio achieved a return of 6%.

Financial results for Ferd AS

Ferd AS is an investment company, and recognition of assets at fair value is of key importance. Accordingly, Ferd presents accounts that report its investments at fair value, including the subsidiary companies of Ferd AS.

Ferd AS reports operating profit of NOK 5,233 million for 2013, representing an increase of NOK 1,493 million from 2012.

Ferd AS reports operating profit of NOK 5,233 million for 2013, representing an increase of NOK 1,493 million from 2012. In addition to the matters mentioned above, the most important reason for the profit reported for 2013 was the return from investments in the Herkules funds.

Net cash flow for 2013 was made up of cash from operations of NOK -187 million, NOK 2,785 million from investment activities and NOK -3,237 million from financing activities. The most important elements in the positive cash flow from investment activities were the partial disposal of the ownership interest in Aibel and payments received from Herkules Fund I.

For further commentary on financial results in 2013, the reader is referred to the separate sections on each business area on the following pages.

The annual accounts have been prepared on the going concern assumption, and in accordance with Section 3-3a of the Accounting Act, the Board confirms that the going concern assumption is appropriate.

Financial results and cash flow for Ferd (Ferd AS group)

Operating revenue was NOK 13.8 billion in 2013 as compared to NOK 14.2 billion in 2012. The main reason for the decrease in revenue was that in 2012 Ferd recognised to income NOK 3.2 billion in respect of the increased value of shares and equity participations, while in 2013 Ferd earned NOK 2.7 billion from its financial investments.

Sales revenue increased from NOK 10.5 billion in 2012 to NOK 11.0 billion in 2013. Consolidated sales revenue reported by Ferd for 2013 includes the revenue reported by Servi Group from August 2013. Elopak reported operating revenue of NOK 6.0 billion in 2013, up by NOK 0.1 billion from the previous year. The increase was due to the weakness of the Norwegian krone since Elopak’s revenue is denominated in euro.

The group’s financial items showed net expense of NOK 256 million in 2013, which was in line with the previous year.

Ferd has a low effective tax rate because a large part of its earnings is generated from investments in shares. Under the exemption model, gains on shares are not taxable. The group’s net tax charge for 2013 was NOK 267 million as compared to a charge of NOK 187 million for 2012.

Net cash flow for 2013 was made up of cash from operations of NOK 786 million, cash from investment activities of NOK 1,115 million, and cash from financing activities of NOK -2,369 million. The most important factor in the negative cash flow from investment activities was the repayment of borrowings by the parent company Ferd AS.

Strategy

The overall vision for Ferd’s activities is to ‘create enduring value and leave clear footprints’. Ferd’s corporate mission statement states that the group will hold a combination of financial portfolios that represent diversification for Ferd and industrial investments where Ferd has ownership positions that give it a significant influence. Ferd will accordingly strive to maximise its value-adjusted equity capital over time. Ferd’s owner has set a target for Ferd to generate an annual return on value-adjusted equity of at least 10% over time.

The approach to risk exposure taken by the owner and the Board of Directors is one of the most important parameters for Ferd’s activities.

The approach to risk exposure taken by the owner and the Board of Directors is one of the most important parameters for Ferd’s activities. This defines Ferd’s risk-bearing capacity, which is an expression of the maximum risk exposure permitted across the composition of Ferd’s overall portfolio. Ferd’s risk willingness, which determines how much of its risk-bearing capacity should be used, will vary over time, reflecting both the availability of attractive investment opportunities and the company’s view on general market conditions.

The Board keeps Ferd's risk capacity under continuous review. The assessment of how Ferd's risk capital is allocated represents one of the Board’s most important tasks, since risk exposure and return are largely determined by the assets in which Ferd invests. The allocation of new capital, as well as the reallocation of capital between business areas, represents a systematic approach to making use of the group's capital base and risk-bearing capacity.

It is Ferd’s intention that its allocation of capital should be characterised by a high equity exposure and good risk diversification. Good risk diversification helps to ensure that Ferd can maintain its exposure to equity investments, even at times when other players have less access to capital. In addition, maintaining strong liquidity enables us to maintain our freedom to operate as we wish even in more difficult times.

Ferd’s equity capital investments represent a well-diversified portfolio, and the overall performance shows a relatively strong correlation with the performance of Norwegian and international stock markets. Ferd Real Estate and Ferd Hedge Funds help to reduce the group’s overall risk exposure, not only because these investments involve less risk than investing in equities, but also because they have a moderate correlation with Ferd’s other asset portfolios over time.

Asset allocation must be consistent with the owner’s willingness and ability to assume risk. This provides guidance on how large a proportion of equity can be invested in asset classes with a high risk of fall in value. The risk of fall in value is measured and monitored with the help of stress testing. The risk of fall in value at the start of 2014 was a little higher than the average for 2013, but the risk of fall in value is still lower than has been the case in recent years.

Ferd aims to maintain sound creditworthiness at all times in order to ensure that it has freedom of manoeuvre and can readily access low-cost financing at short notice when it wishes. Ferd's objective is that its main banking connections will rate Ferd’s creditworthiness as equivalent to ‘investment grade’. In order to protect Ferd’s other equity from risk, Ferd Capital and Ferd Real Estate carry out their investments as stand-alone projects without guarantees from Ferd. Both Ferd and its banks pay close attention to liquidity. Ferd has always held liquidity comfortably in excess of the minimum liquidity requirements we impose internally and the requirements to which we are committed by loan agreements at the parent company level. Ferd works on the assumption that the return generated by financial investments should help to cover current interest payments. It is therefore important that the balance sheet is liquid, and that the maturity profile of assets corresponds closely to the maturity profile of liabilities.

It is Ferd’s intention that its allocation of capital should be characterised by a high equity exposure and good risk diversification.

Ferd has a proactive approach to currency exposure. We work on the assumption that Ferd will always have a certain proportion of its equity invested in euro, US dollar and Swedish krona denominated investments, and accordingly do not hedge all currency exposure against the Norwegian krone. Subject to the actual exposure being within the strategic currency basket, Ferd does not currency hedge its investments. If the exposure to any one currency becomes too great or too small, the composition of the currency basket is adjusted by borrowing in the currency in question at the parent company level, or by using derivatives.

Ferd holds only very limited investments in interest-bearing securities. Its exposure to interest rate risk arises from interest-bearing investments and any borrowing that may have been drawn down, and is managed by group treasury in accordance with established guidelines.

Further information on Ferd’s strategy can be found in a separate article.

Corporate Governance

Ferd is a relatively large corporate group, with a single controlling owner. Despite this, the Board of Directors of Ferd Holding AS has substantially the same responsibilities and authority as the board of a public company.

Not all the sections of the Norwegian Code of Practice for Corporate Governance are relevant to a family-owned company such as Ferd, but Ferd complies with the Code where it is relevant and applicable. Further information is provided in a separate article on corporate governance. The Board of Directors of Ferd Holding held six Board meetings in 2013.

Ferd Capital

Since Ferd Capital was established as a business area in 2007, Ferd has allocated a sizeable amount of capital for new investments. Over the course of this period, Ferd Capital has evaluated a large number of companies and has been actively involved in many potential transactions. Ferd Capital attaches great importance to creating a flow of investment opportunities through its own research and proactive contacts with potential sellers.

When making investment decisions, Ferd Capital attaches only little weight to the overall macroeconomic outlook. Company-specific factors play the crucial role when deciding whether or not investment opportunities are attractive. In July 2013, Ferd Capital purchased 100% of the shares in Servi Group, which is the market leader for hydraulic solutions and systems in the Norwegian offshore industry. Ferd Capital sold its investment in Help Forsikring to ARAG SE in May. Napatech A/S was admitted to listing on the Oslo Stock Exchange in December 2013, and Ferd Capital retained an ownership interest of approximately 22% following the initial public offering. Ferd Capital actively seeks "add-on" investments for its existing portfolio companies, and in early 2014 Interwell increased its ownership interest in the well technology company Vosstech from 33% to 66%.

Aibel

Aibel reported turnover of NOK 12,456 million in 2013 as compared to NOK 10,442 million in 2012. EBITDA was NOK 911 million after adjusting for non-recurring items, as compared to NOK 875 million in 2012.

Aibel was awarded a contract for the hook-up of the Ivar Aasen platform in 2013. In addition, Det norske, as operator of the Ivar Aasen development, announced its intention to award Aibel the contracts for maintenance and modification tasks as well as operational support for Ivar Aasen. Statoil demonstrated its continuing confidence in Aibel by exercising an option to extend its current contract for two more years.

Aibel will accordingly continue to be Statoil's largest supplier of maintenance and modification services. Aibel's order backlog at the end of 2013 was in the order of NOK 17 billion.

At the start of 2014, Statoil indicated to Aibel that it wished to reduce the volume of activity to be carried out under its framework contract relative to the plan for 2014 that it had previously communicated. In addition, Statoil intends to reduce or defer new modification assignments. These developments have made it necessary for Aibel to adapt its resources to the level of activity now anticipated, and this has unfortunately led to a significant reduction in headcount. While Aibel is facing somewhat weaker market conditions in the short term, the market is expected to be stronger in the longer term. Major fields such as Johan Sverdrup will require sizeable investment on the Norwegian continental shelf in the years ahead. Aibel's objective is to reinforce its position as one of the leading oil service companies for the oil and gas industry on the Norwegian continental shelf, while at the same time establishing a stronger position in the renewable energy sector.

Elopak

Elopak’s business is in general less cyclical than many other industries, and should therefore not experience any major loss of volume as a result of changes in economic conditions. However, the company expects carton sales for the juice market to be more volatile since demand for these products is to some extent affected by the state of consumers’ finances. Elopak’s total revenue was NOK 5,967 million in 2013, compared to NOK 5,839 million in 2012. The increase in reported revenue is the result of a higher average euro exchange rate in 2013 than in 2012. Elopak's euro-denominated reported revenue in 2013 was EUR 769 million as compared to EUR 784 million in 2012. The reduction in revenue was primarily the result of lower sales of screw closures and filling machinery. The volume of cartons sales was somewhat higher than in 2012.

Operating profit was NOK 378 million, as compared to NOK 273 million in 2012. The main reason for the reported increase was that 2012 operating profit was affected by extraordinary provisions for costs involved in restructuring the company's production capacity in Europe.

Elopak made major investments in 2013 in establishing EloBrick TM (roll-feed aseptic carton packaging) as a separate business area, with the associated organisational structure and production facilities. The first phase of the construction of production capacity for EloBrick was completed in 2013, with the first commercial deliveries taking place at the end of the year. Elopak also continued its strategy for growth in the aseptic packaging market. A new aseptic filling machine was installed with a test customer for industrial testing. The test results have been promising, and have confirmed the machine's capability. The company decided in 2013 to upgrade and expand its production capacity in Canada, and production will be transferred to a new facility in Montreal.

The markets for Elopak's products are expected to be relatively stable in 2014 compared to the previous year. There is still some uncertainty over economic growth and unemployment in a number of the European markets, but there are also some signs of improvement.

Elopak will continue to pursue its growth strategy in 2014, and will add additional production capacity for the aseptic segment. The new factory in Russia completed in 2012 has given Elopak a stronger position in a growth market. In addition to this, the new factory in Montreal will create greater opportunities for growth in the North American market.

TeleComputing

TeleComputing reported operating profit of NOK 121 million in 2013, which was somewhat higher than in 2012. TeleComputing increased its revenue by 5% in 2013, representing a rate of growth that is significantly higher than the market as a whole, but below the group's long-term target. There were sizeable differences between the revenue performance reported by the three business areas: Lower revenue in 2013 than in 2012 for the Swedish consulting activities as a result of the challenging economic conditions in Sweden, weak revenue growth for the Norwegian IT operating services business as a result of increased price competition, and strong revenue growth in the Swedish IT operating services business. TeleComputing was successful in 2013 in securing renewals of many important customer contracts, while at the same time attracting many new customers. This resulted in a larger order backlog at the end of 2013 than at any time in the company's history. TeleComputing’s objective is to maintain industry-leading profit margins, and this was again achieved in 2013.

Revenue from consulting activities will continue to be affected by the economic situation in Sweden, and the company sees some signs of improvement in the Swedish economy at the start of 2014. IT operating services activities are expected to continue to show sound growth, supported by a record-high order backlog.

Mestergruppen

Mestergruppen reported revenue of NOK 2,672 million in 2013, representing a drop in organic revenue from 2012 of around 4%. Normalised EBITDA was NOK 82 million compared to NOK 78 million in 2012. Despite weak market conditions and a fall in revenue in 2013, Mestergruppen succeeded in improving its normalised EBITDA relative to 2012. This was principally achieved through a stronger contribution ratio as a result of better purchasing terms, as well as some improvements on the cost side.

Market conditions in 2014 are expected to be stable, but the medium-term outlook is for the sector to maintain average growth in line with its historical trend. The Norwegian building materials industry is highly competitive and very dependent on prevailing economic conditions, and the industry is very fragmented.

Interwell

Interwell is a leading Norwegian supplier of high-technology well solutions for the international oil and gas industry. The company reported revenue of NOK 762 million in 2013, representing an increase of over 50% from 2012 as the result of the company's successful international expansion and its continuing focus on technological development.

Interwell’s EBITDA for 2013 was NOK 265 million, up by NOK 84 million from the previous year. Interwell maintains close dialogue on the development of new solutions with its major customers, both on the Norwegian continental shelf and internationally, in order to ensure that the company will be able to meet the changing needs of the market in the future.

Interwell has set ambitious targets, and expects strong growth both on the Norwegian continental shelf and in other international regions. On the Norwegian continental shelf, the company continues to focus on promoting its unique services and technology to both existing and new customers. In addition to its relationship with Statoil, the company has made important progress with other operators on the Norwegian continental shelf. The UK generated strong growth for Interwell in 2013. Accordingly Interwell's international operations are well-positioned for further growth in the years ahead.

Swix Sport

Swix Sport reported EBITDA of NOK 71 million for 2013 as compared to NOK 51 million in 2012. Revenue increased from NOK 687 million in 2012 to NOK 757 million in 2013. 2013 was a more normal year following a period of challenging market conditions in the sporting goods sector.

Swix operates through two main divisions, Sport (Swix and Toko) and Outdoor (Ulvang and Lundhags) in order to emphasise its focus on the outdoor segment. During the course of 2013, Swix took over sales and distribution in the Swedish market, and was able to generate a significant increase in revenue from Sweden. Swix generates approximately 50% of its revenue from markets other than Norway.

The continuing trend for greater interest in health and outdoor pursuits continues to offer good growth prospects for the sporting goods industry in general, and Swix Sport in particular. Norwegians are the biggest spenders per head on sports clothing and sports equipment in Europe, and this is reflected in the favourable conditions seen in Swix's home market.

Swix's objective is to place greater focus on the outdoors activity segment using the Lundhags and Ulvang brands in order to reduce seasonal variation in its revenue, while at the same time ensuring that Swix maintains its position as a global leader in its segments of the winter sports market.

Servi Group

Servi Group reported revenue of NOK 840 million in 2013 as compared to NOK 777 million in 2012, making 2013 a record year for the company, principally driven by high levels of activity in the rig, marine and offshore markets. Normalised EBITDA for 2013 was NOK 90 million, down by NOK 3 million from 2012.

Servi is well-positioned for continuing organic growth. The company is experiencing rapid growth in the area of rig new builds, a healthy flow of orders from its largest customers and a continuing positive trend in the marine segment. In 2014, the company will intensify its focus on product areas such as accumulators and hydraulic systems in general, as well as increasing its focus on the subsea and maintenance market. The opening of its own office in Houston has given Servi a good starting point to attract new customers in the American market. Servi's objective is to maintain its position as the market leader and preferred hydraulics partner for its customers. The company places great importance on closeness to its customers, combined with continuous development of its technology and services, in order to maintain its market-leading position.

Ferd Invest

Ferd Invest reported an operating profit of NOK 1,471 million for 2013 as compared to an operating profit of NOK 631 million for the previous year. 2013 was a good year for the Nordic stock markets. The Nordic markets gained between 46% (Helsinki) and 24% (Oslo) in Norwegian krone terms. The weakness of the Norwegian krone was the main reason for the other Nordic markets to produce higher returns than the Oslo market for Ferd Invest in 2013.

2013 saw an increase in investors' appetite for risk, and they were willing to price shares on higher multiples. The resultant increase in pricing ratios, rather than growth in corporate earnings, was the main driver for higher share prices in 2013.

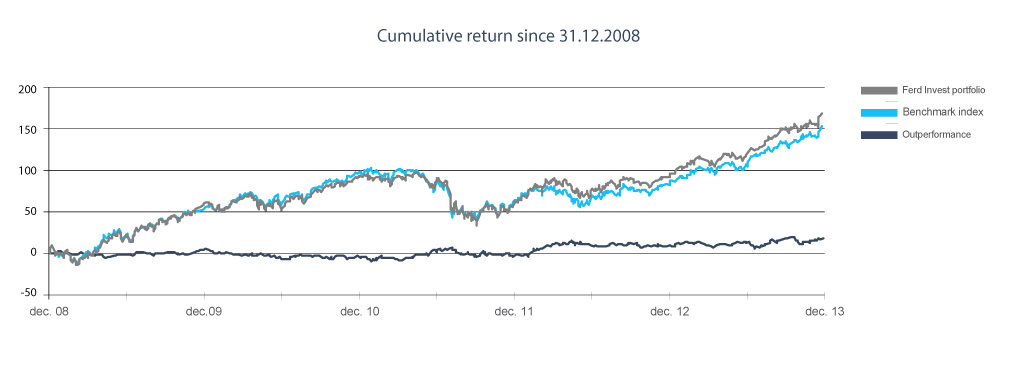

The market value of the Ferd Invest portfolio grew by 41% in 2013, which was three percentage points better than the benchmark index for the portfolio.

The market value of the Ferd Invest portfolio grew by 41% in 2013, which was three percentage points better than the benchmark index for the portfolio. Ferd Invest's largest investment over the course of 2013, Opera Software, gained 163% in 2013. Together with strong performance from Autoliv, Novozymes and Transmode, Opera Software made the biggest contribution to a good year for Ferd Invest.

The market value of the Ferd Invest portfolio grew by 41% in 2013, which was three percentage points better than the benchmark index for the portfolio. Ferd Invest's largest investment over the course of 2013, Opera Software, gained 163% in 2013. Together with strong performance from Autoliv, Novozymes and Transmode, Opera Software made the biggest contribution to a good year for Ferd Invest.

At the close of 2013, the market value of the Ferd Invest portfolio was NOK 5 billion. Investments are divided between the three Scandinavian stock markets, in addition to the Helsinki stock market. The largest investments at the close of 2013 were in Opera Software, TDC, Autoliv, Novo Nordisk and Nokian Tyres. These investments accounted for around 35% of the total value of the portfolio at year-end.

The emerging optimism that Ferd Invest identified at the start of last year continued to strengthen over the course of 2013.

Ferd Hedge Fund

Ferd’s objective for its hedge fund portfolio is to achieve a satisfactory risk-adjusted return over time, both relative to the market and in absolute terms. In order to achieve good risk diversification, it is important that the composition of the portfolio features a range of funds which generate returns that are not dependent on the same risk factors. In addition, as part of risk diversification for Ferd’s overall portfolio, the hedge fund portfolio normally has a relatively small weighting in funds that are heavily exposed to the stock market. Ferd Hedge Fund’s portfolio achieved a return of 7.7% in 2013, In line with the benchmark index (HFRI Fund of Funds Conservative) against which the performance of the portfolio is measured. Operating profit was NOK 191 million. The market value of the portfolio at the end of 2013 was NOK 2.3 billion.

The market value of the hedge fund portfolio at the end of 2013 was NOK 2.3 billion.

Equities-related strategies were among the hedge fund strategies that produced a good performance in 2013. What are known as "distressed" funds also had a good year as a result of improving prices for defaulted fixed income securities and a sharp improvement in the share prices of newly restructured companies.

There are good reasons to suggest that the actions of the Federal Reserve (the American central bank) and market expectations of higher interest rates will continue to be the focus of market attention, and may cause increased market volatility. The situation in China may also be an important factor in 2014 and affect the return for the year. However, given the current low levels of interest rates it seems possible that we may see another good year for stock markets. The main focus for Ferd Hedge Funds will be to maintain a robust and well-diversified portfolio that reflects a range of hedge fund strategies and markets.

Ferd Special Investments

The investment mandate for ‘Special Investments’ was put in place in spring 2010, and Special Investments became a separate business area in autumn 2012. The objective for this business area is to benefit from investment opportunities that Ferd is well-placed both to evaluate and to hold, but which fall outside the group’s other mandates.

Investments held in this portfolio share the common feature of a favourable balance between the potential return and the risk of loss. Particular attention is paid to being able to identify good protection against downside risk. Investment opportunities that satisfy the portfolio’s objective have been identified in the secondary market for hedge fund units, where imbalances between the number of buyers and sellers of these units have allowed Ferd to purchase units below their estimated value. The return since the portfolio was established is NOK 892 million. The return in 2013 was NOK 573 million, which represents an annual return of 37%.

2013 was a very good year for the Special Investments portfolio, both in terms of what we believe to be attractive new investments and in terms of the performance of the portfolio in general. The return for the year was NOK 573 million, representing the highest nominal return since the Special Investments mandate was established. In total, new investments in the year amounted to NOK 380 million, but Special Investments received NOK 599 million from disposals and dividends. The portfolio was valued at year-end at NOK 2.3 billion.

2013 was a very good year for the Special Investments portfolio, both in terms of what we believe to be attractive new investments and in terms of the performance of the portfolio in general.

Special Investments continues to see many opportunities in the areas of restructuring and illiquid hedge funds, which were the focus of its activities in 2013. Special Investments has not been active in the Norwegian bond market for several years.

Ferd Real Estate

Ferd Real Estate reported an operating profit of NOK 83 million for 2013, as compared to NOK 356 million in 2012. The profit reported for 2013 was due principally to a good return on Ferd Real Estate's investment in a European real estate fund, together with the cash flow from rented properties. In 2012, the land intended for phases 5 and 6 of Tiedemannsbyen (a residential development project at Ensjø in Oslo) was valued at estimated fair value based on the land being developed as a residential project. Prior to 2012, this part of the overall Tiedemanns property was valued for accounting purposes as a warehousing site.

Ferd Real Estate's value-adjusted equity was NOK 1.5 billion at the end of 2013, with a return on the portfolio of 6% for the year.

The Tiedemannsbyen project will comprise around 1,200 residential units in total, and development will take place over a period of 10 to 15 years. The initial construction of approximately 600 residential units is being carried out by Tiedemannsbyen DA. Tiedemannsbyen DA is a 50-50 joint venture between Ferd Real Estate and Skanska Bolig. The first phase of off-plan sales for the Petersborgkvartalet sub-area was launched in autumn 2013, and comprises 61 apartments in total. The Petersborgkvartalet will comprise 204 residential units in total.

Ferd Real Estate was involved in the construction of a new office building in Bergen for Aibel in 2013. The building is due for completion in the first half of 2015. In autumn 2013, Ferd capital Estate purchased an office building at Lysaker on the outskirts of Oslo. Strandveien 4-8 is a development property that Ferd Real Estate will renovate for occupation by a new tenant, and a 12-year lease has been signed for approximately 13,500 m² of the building's total space of 18,000 m².

Ferd Real Estate continues to work on finding new investment opportunities. Over recent years, high construction costs have resulted in considerable downward pressure on the profit margins that can be achieved on real estate development.

The outlook for costs is likely to improve in pace with the reduction in the number of new projects being started. This will have a positive effect on the development sites awaiting construction and other projects in the Ferd Real Estate portfolio.

Ferd Social Entrepreneurs

Ferd Social Entrepreneurs (FSE) invests in social entrepreneurs who reflect Ferd’s vision of creating enduring value and leaving a clear footprint.

FSE has chosen to apply a focused strategy for its interpretation of what is included in the definition of social entrepreneurship. Social entrepreneurs must play a part in solving social problems while at the same time demonstrating a good likelihood that their activities will be financially self-sufficient over time. FSE principally supports social entrepreneurs who work with children and young people.

The number of enquiries received by FSE increased from 243 in 2012 to over 400 in 2013. FSE believes that its portfolio is now virtually complete with 10-11 social businesses. Lyk-z og døtre was the only addition to the portfolio in 2013. Lyk-z og døtre won the Social Entrepreneur of the Year award in 2012, and works with young people to help them clarify their life goals and make sound strategic decisions. The objective for all FSE's investments is that the social entrepreneurs should become self-sufficient over a period of 3-6 years. At the end of 2013, FSE established an Alumni portfolio for the social entrepreneurs that have achieved the objective of financial sustainability.

The Board of Ferd Holding AS has allocated up to NOK 25 million annually for work with social entrepreneurship. In addition, Ferd's other business areas and subsidiaries support social entrepreneurs with their time and commitment as board members and through other assistance.

Health, safety, environmental matters and employment equality

Recent years have seen increasing emphasis on environmental issues in the industrialised countries of the world. None of the group’s activities produces discharges that require licensing and environmental monitoring.

Elopak operates in an industry where both customers and suppliers are very aware of global warming, CO2 emissions, carbon footprint, product lifecycle and recycling the materials used. Relative to alternative forms of packaging, carton-based packaging rates very highly on these criteria. Elopak only uses board sourced from forestry that is managed in accordance with sustainable principles.

All purchases of paper-based carton board in Europe are sourced from producers approved by the FSC (Forest Stewardship Council). Elopak also promotes recycling of used cartons through its participation in industry alliances. In Europe, approximately 39% of all used cartons were recycled in 2013, representing an increase from 37% in 2012.

The Ferd group had 4,067 employees at the end of 2013, and after including employees of Aibel and Interwell the total number was 10,161. The proportion of female employees in the Ferd group is 23%. Sick leave amounted to 3.4% for the Ferd group in 2013. Ferd AS had 40 employees at the close of 2013, of which 25 are male and 15 are female. The Board of Directors of Ferd AS comprises one female director and four male directors. No serious accidents or injuries were reported at Ferd AS in 2013.

It is the company’s policy to treat female and male employees equally. This is reflected in a policy of equal salaries for equal responsibilities, and a recruitment policy that emphasises the selection of candidates with the right expertise, experience and qualifications to meet the requirements of the position in question. The company strives to be an attractive employer for all employees, regardless of gender, disability, religion, lifestyle, ethnicity or national origin.

The Board proposes that the profit for the year of NOK 4,993 million should be transferred to other equity.

Bærum, 8 April 2014

The Board of Directors of Ferd AS